Investing in Ukraine: Challenges and Prospects for European Union and Czech Investors

In her contribution to the "Analysis IIR - A changing world 2022", Federica Cristani focused on the future of EU and Czech investments in Ukraine.

Russiaʼs aggression against Ukraine makes investors take risks and worry about their future business. European investors in Ukraine face tremendous challenges. There are two main groups of challenges for the EU investors (including the Czech ones): first, the immediate challenges that investors are addressing in their day-to-day business management; and second, the prospects – and again, challenges – for the post-war reconstruction phase, which are mainly related to the difficulties of engaging in long-term projects.

Some companies have already decided to relocate their offices and commercial operations in Ukraine, either moving them to the western part of Ukraine, or to neighbouring countries, like Poland. Czech investors also struggle in this respect. Currently, Czech companies have more than 200 offices and subsidiaries in Ukraine.

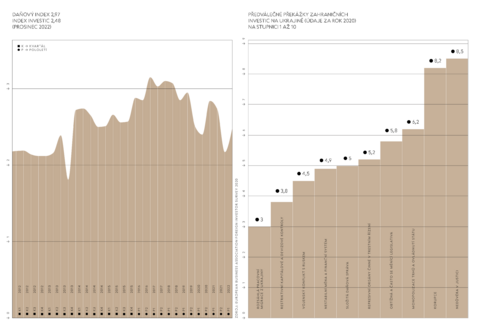

Foreign direct investment (FDI) inflows to Ukraine had already been quite modest in the past years. Ukraine faced important outflows in 2014, after the annexation of Crimea, and later during the COVID-19 pandemic. But since the beginning of the war, the situation has dramatically worsened. While FDI to Ukraine amounted to 595.6 million EUR in December 2021, it immediately decreased to -597.55 million EUR (with FDI outflows drastically exceeding FDI inflows) in February 2022. In the following months, thanks to loans and aid from external donors and some national incentives, FDI started to increase again, reaching 187.88 million EUR in September 2022, with the highest volume of FDI coming from European Union (EU) Member States. The dramatic drop in FDI shows the impact of the invasion on Ukraine’s economy, which in turn is also affecting global investment flows.

DOING BUSINESS IN UKRAINE: COSTLY AND RISKY

The war has increased the costs of doing business in Ukraine. Suffice to recall the recurrent problems linked to the shortage of employers or the logistic problems. Since the war in Ukraine began, risks of investing in the country remain high. Yet, the Ukrainian government have been trying to encourage FDI flows. In particular, several incentives for FDI were adopted in the creation of industrial parks. The support of the EU is crucial for investors in Ukraine, but this support is not sufficient at the moment. Although the EU has exclusive competence in FDI, so far it has not taken any significant steps in addressing the FDI situation in Ukraine, leaving each member state to address the issue on its own. And in turn, the member states do not seem to coordinate among themselves in this matter. The war makes it difficult for investors to engage in long-term projects. However, a number of prospects seem to be opening up for the reconstruction phase, both in the short and in the long-term.

The short-term goal for Ukraine is to maintain macroeconomic stability in its territory and ensure a solid economic basis for the recovery. International partners are already supporting Ukraine in the form of grants or loans. The international support includes the EU-funded “Rebuild Ukraine Facility”, the International Monetary Fundʼs “Account for Ukraine”, the European Bank for Reconstruction and Developmentʼs (EBRD) 2 billion EUR resilience package, and a multi-donor platform led by the World Bank. The long-term macroeconomic policies should focus on reconstruction. This will also allow for “building back better” the investment climate. Ukraine has sustained losses amounting to 565 billion EUR since the beginning of the war. And according to the EBRD, around 60% of Ukraine’s GDP was generated in territories that are now directly affected by the war, like the Donbass region. Public and private investment will be needed for large sectors of the Ukrainian economy, like businesses’ factories and public infrastructures. To attract long-term FDI, Ukraine would need to (re-)build its legal framework. Even before the war, the country was developing a number of reforms to improve its investment environment. Still, challenges remain, especially when it comes

to establishment and licensing procedures, public procurement efficiency and anti-corruption regulation.

THE CZECH APPROACH: INVESTMENT INTEREST, NEED FOR COORDINATION

Many foreign companies in Ukraine have relocated their business abroad. This is also the fate of Czech companies operating in Ukraine. More than ⅓ of them have offices in areas of conflict and/or in the occupied territories.5 Many Czech companies are still in Ukraine, but most of them are relocating their offices to the western part of Ukraine, and thus keeping their everyday business alive. A growing number of Czech companies are waiting for the post-war reconstruction to start before they enter certain segments of the markets – especially in the agriculture, industry and energy sectors. A key question is how to access state guarantees – an issue that is currently under discussion at the parliamentary level in Czechia.

Another big question is the possible establishment of funds, either from the European Commission or from the Czech government, for companies that will participate in the post-war reconstruction. Czech companies, which are mainly small and medium enterprises, fear being left out of the group receiving these benefits as preference will likely rather be given to bigger companies from other countries.

At the same time, initiatives are being taken at the national level to help Czech businesses in Ukraine. In March 2022, the Czech Ministry of Industry and Trade established a working group which includes ministerial representatives, and representatives of the Confederation of Industry, the Chamber of Commerce and the Confederation of Employersʼ and Business Associations in order to monitor the situation in Ukraine and prepare long-term projects for the Czech industry. At the same time, the agency CzechTrade has launched the Export for the Reconstruction of Ukraine program in cooperation with the Ministry of Industry and Trade and the agency CzechInvest in order to increase the collaboration between Czech and Ukrainian companies. Moreover, the Ministry created the “Business Club of Ukraineˮ, a platform that Czech companies can join in order to be immediately put in contact with their Ukrainian counterparts and be involved in business projects in Ukraine.

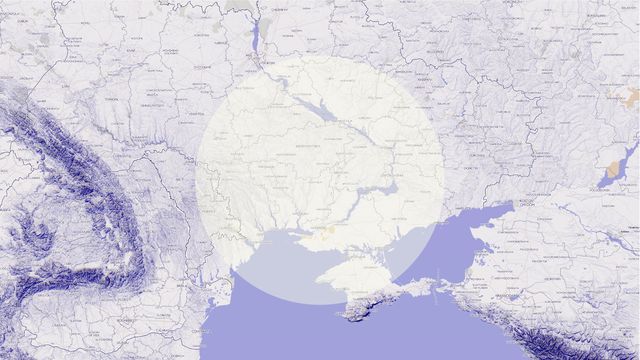

On 31 October 2022, Ukraine and Czechia signed a Memorandum on further economic and political cooperation. In particular, Prague commits to participate in the reconstruction of the Dnepropetrovsk Oblast, the main industrial region in Ukraine – and a major hub for relocated enterprises. The focus would be on reconstruction projects in the fields of energy, transport, education and healthcare.6 The Czech government has the opportunity to play a role in the reconstruction of post-war Ukraine. The country can be a model case for future reconstruction projects in other war-torn territories (e.g. in Africa).

However, what is still lacking at the national level is an efficient coordination among all relevant stakeholders. This is true especially when considering, for example, the role of non-governmental organizations (NGOs). While they have had an important role – and success – in fundraising campaigns for Ukraine, they have not engaged with (a) national government (s) and/or business companies for possible joint activities. And traditionally, NGOs can play an essential role in reconstruction phases, since they are able to link (a) state(s) and civil society and favour cooperation.

INCENTIVES FOR INVESTORS

The foreign investors and relevant stakeholders in this case share a feeling of “waiting for what the future holdsˮ. At the same time, they are engaging in long-term projects, like the “Business Club of Ukraineˮ, which seems to be going in the right direction of favouring – and possibly increasing – FDI to Ukraine.

One of the main obstacles to the promotion of FDI to Ukraine is insufficient coordination among the relevant public and private actors. To address this issue with a longterm programme, it is necessary to coordinate all the relevant efforts at all levels. In particular, governments and multilateral institutions (e.g. the EBRD) can coordinate their activities to provide subsidies (e.g. tax incentives) to companies investing in Ukraine. At the same time, international cooperation would be essential for supporting Ukraine in (re-)building its regulatory (investment) environment.

→ The Russian aggression against Ukraine has had a severe impact on FDI inflows to the latter country.

→ Foreign companies are waiting to engage in long-term post-war reconstruction projects in Ukraine. However, an open question in this case is how to access incentive funds and state guarantees.

→ National governments and international organisations should address the lack of coordination among the relevant stakeholders and thus create a relevant network of players that will be prepared to join the post-war reconstruction phase in Ukraine.

The chapter was published in this year's annual publication "Svět v proměnách 2023: Analýzy ÚMV".